Hey! Are you thinking about growing your wealth through regular investing? The UAE SIP Calculator might just become your new favorite financial buddy. It’s a brilliant tool that helps you understand how your monthly investments in mutual funds could grow over time. Think of it as your personal wealth-building GPS, showing you the smartest route to your financial goals! Trust me, it makes planning your financial future way less intimidating!

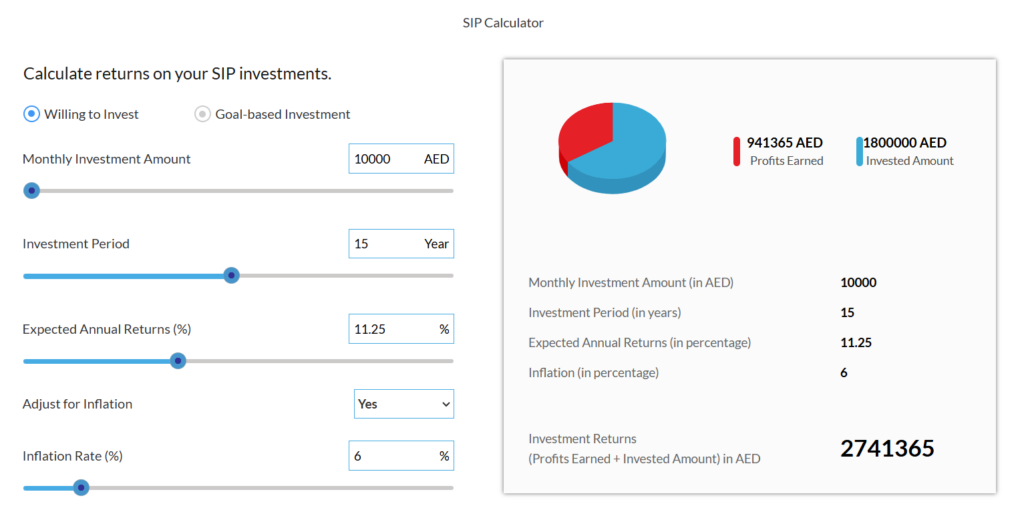

Online SIP Calculator

Think of the UAE SIP Calculator as your financial crystal ball (but with actual math behind it!). This handy tool helps you figure out what your Systematic Investment Plan (SIP) could look like down the road. The best part? It’s super easy to use!

Here’s what you’ll need to get started:

- Monthly Investment: Enter the fixed amount you plan to invest each month (in AED).

- Investment Duration: Specify how long you want to invest (in years).

- Expected Rate of Return: Choose the expected annual return rate (usually between 8-12%).

- Inflation Rate (optional): Factor in inflation to calculate your returns in real terms.

Just plug these numbers in, and boom! You’ll see how your investment could grow over time. Pretty cool, right?

How Does the SIP Calculator Work?

Here’s where it gets interesting! The calculator uses some fancy math (don’t worry, it does all the heavy lifting) to show you how compound returns work their magic. When you invest regularly, your returns start snowballing – that means your profits start making their own profits!

For the math nerds out there, here’s the formula it uses:

Future Value (FV) = P × {[(1 + r)^n – 1] / r} × (1 + r)

Where:

- P = How much you’re putting in monthly

- r = Your monthly return rate

- n = How many months you’ll be investing

Example Calculation:

Say you invest AED 10,000 every month for 10 years, hoping for an 11.25% annual return. Here’s what could happen:

- Total Investment: AED 1,200,000 (AED 10,000 per month for 12 months for 10 years)

- Profits: AED 1,240,000 (Approx. based on the return rate)

- Total Value at the End: AED 2,440,000

Not bad for letting your money do the work, right?

Sample SIP Calculation

| Monthly Investment (AED) | Investment Duration (Years) | Expected Annual Return (%) | Total Investment (AED) | Estimated Value at Maturity (AED) |

| 1,000 | 5 | 8 | 60,000 | 77,010 |

| 2,000 | 5 | 8 | 120,000 | 154,020 |

| 5,000 | 10 | 10 | 600,000 | 1,129,207 |

| 10,000 | 10 | 11.25 | 1,200,000 | 2,440,000 |

| 15,000 | 15 | 9 | 2,700,000 | 5,435,194 |

How to Read the Table:

- Monthly Investment (AED): The amount you invest every month.

- Investment Duration (Years): The number of years you plan to invest for.

- Expected Annual Return (%): The estimated annual return on investment, which could vary depending on the mutual fund or stock market performance.

- Total Investment (AED): The total amount you would invest over the period (monthly investment × number of months).

- Estimated Value at Maturity (AED): The expected amount at the end of the investment duration, including both principal and profits, based on the expected return.

Why Use the SIP Calculator?

Let me tell you why this tool is such a game-changer:

- Goal-Oriented Investments: It helps you plan for specific financial goals, whether it’s retirement, buying a home, or funding education.

- Real-Time Adjustments: The calculator allows you to make adjustments if your financial goals or situation change. You can modify the monthly investment or expected return at any time.

- Easy Planning: It provides a clear and easy-to-understand breakdown of how your investment will grow over time, making it accessible for both beginners and seasoned investors.

- Accurate Financial Forecasting: With inflation and other economic factors in mind, the SIP Calculator provides a realistic estimate of your future wealth, helping you stay on track to meet your targets.

Frequently Asked Questions (FAQ)

Can I change my SIP amount after starting?

Yes, you can increase or decrease your monthly SIP amount anytime based on your financial situation. This flexibility allows you to adjust your plan as needed.

What is the best rate of return to use in the SIP Calculator?

The rate of return can vary depending on the mutual fund you choose. A typical range is between 8-12%, with higher returns generally associated with higher-risk investments.

How do I calculate the SIP amount required to reach my financial goal?

If you have a specific goal in mind, such as saving AED 1 million in 10 years, the SIP Calculator can help you determine the monthly amount you need to invest to reach that goal. Just input your desired target amount and the tool will calculate the monthly contribution.

Is the SIP Calculator accurate?

The SIP Calculator provides estimates based on historical returns and assumptions. While it’s a helpful guide, actual returns can vary due to market conditions and other factors.

How often should I check my SIP performance?

It’s a good practice to review your SIP performance annually or when your financial goals change. This will help you adjust your investments if needed to stay on track.

The UAE SIP Calculator takes the mystery out of investing and helps you build your wealth with confidence. Whether you’re just dipping your toes into investing or you’re looking to shake up your existing plan, this tool makes it super easy to see where your money could take you.

Remember, building wealth isn’t about making one big investment – it’s about those consistent, smart moves you make month after month. And with this calculator as your guide, you’ll be amazed at how those small monthly investments can add up to something truly spectacular!