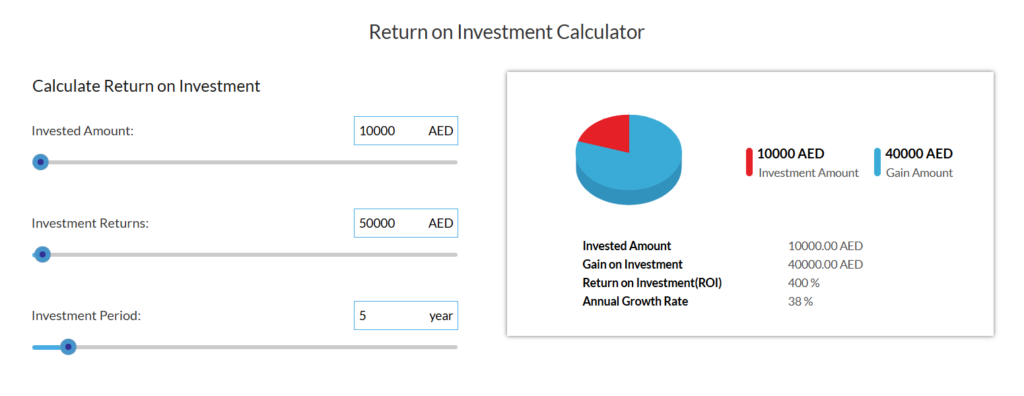

Ever wondered if your investments are really pulling their weight? Whether you’re eyeing that sweet real estate deal or thinking about jumping into stocks, knowing your potential returns is crucial. That’s where the ROI (Return on Investment) calculator comes in – it’s like your personal investment detective, helping you figure out if your money’s working hard enough for you!

Online ROI Calculator

Think of the ROI calculator as your financial GPS – it helps you navigate through the investment landscape by showing you exactly what percentage return you might get on your investment. Pretty cool, right?

Here’s what you need to tell it:

- Investment Amount: Enter the amount of money you plan to invest.

- Investment Returns: Input the expected returns, whether it’s from rental income, capital gains, or dividends.

- Investment Period: Specify the time frame for your investment, whether it’s for one year or several years.

- Service and Other Fees: Don’t forget to include any maintenance costs, service charges, or other fees associated with your investment.

Pop these numbers in, and voilà – you’ll see exactly what kind of return you might get!

How the ROI Calculator Works

Let’s make this super simple – here’s how the calculator thinks:

- Investment Amount: This is the amount of money you’re investing. For example, if you’re purchasing a property, this could be the purchase price.

- Investment Returns: These are the returns you expect from your investment. In real estate, this could include:

- Rental Income: The annual income you earn by renting the property.

- Appreciation: The increase in the value of the property over time.

- Investment Period: This refers to how long you plan to keep the investment. It could be for a short term (e.g., one year) or long term (e.g., 5 years or more).

- Additional Costs: Don’t forget to factor in costs like:

- Broker Fees: A percentage of the investment amount (e.g., 2% of the property purchase price).

- Service Charges: The ongoing costs for maintaining the property.

- DLD Fees: Dubai Land Department fees for registering the property.

Example: Real Estate Investment ROI Calculation

Say you’re thinking about buying a property in Dubai for AED 2,000,000. Here’s how it might look:

- Investment Amount: AED 2,000,000

- Annual Rental Income: AED 160,000

- Appreciation Rate: 3.5% per year

- Broker Fees: AED 40,000

- DLD Fees: AED 80,000

By entering these figures into the ROI calculator, you can determine the total returns, including both rental income and appreciation, and get a percentage ROI over your investment period.

Illustrative Example (5-year period):

| Investment | Amount (AED) |

| Purchase Price | 2,000,000 |

| Annual Rental Income | 160,000 |

| Appreciation (3.5% per year) | 2,593,843 |

| Broker Fees | 40,000 |

| DLD Fees | 80,000 |

| Total Returns | 1,393,843 |

| ROI | 69.7% |

This calculation gives you a clear picture of the potential returns on your real estate investment.

Frequently Asked Questions (FAQ)

What is the ROI formula?

It’s simpler than you think! Take what you got back, subtract what you put in, divide by what you put in, and multiply by 100. That’s your ROI percentage!

Can the ROI calculator be used for investments other than real estate?

Yes! The ROI calculator can be used for any type of investment, including stocks, bonds, mutual funds, or even a business venture. It works by comparing the investment returns to the original investment amount.

How does the ROI calculator factor in maintenance and service charges?

The calculator includes these costs in the total expenses calculation. By doing so, it ensures that you get an accurate picture of the total investment and the net returns, factoring in all relevant expenses.

What should I do if my ROI is negative?

A negative ROI indicates that the investment has lost value over the specified period. It’s important to reassess your investment strategy and consider if holding onto the asset is worthwhile or if you should explore other options.

Can I calculate ROI for long-term investments?

Absolutely! The ROI calculator allows you to calculate the potential returns for both short-term and long-term investments, helping you plan your financial strategy according to your investment goals.

The UAE ROI calculator is like having a financial crystal ball – it helps you peek into the future of your investments without needing a finance degree. Whether you’re a property mogul in the making or just starting your investment journey, this tool helps you make smarter choices with your money. And let’s be honest – who doesn’t want to know if their investment strategy is actually going to pay off? Give it a spin and start making those dirhams work harder for you!