Hey there! Thinking about investing but feeling a bit lost in all the numbers? Don’t worry – we’ve got something that’ll make your life way easier. Meet the UAE Investment Calculator, your friendly guide to figuring out how much your investments could grow. Whether you’re just dipping your toes into investing or you’re already swimming in the deep end, this tool helps you see what your money could do for you.

Online Investment Calculator

Think of the UAE Investment Calculator as your financial fortune teller (but with actual math behind it!). Just feed it some basic info about your investment plans, and it’ll show you what your money might look like down the road. Pretty neat, right?

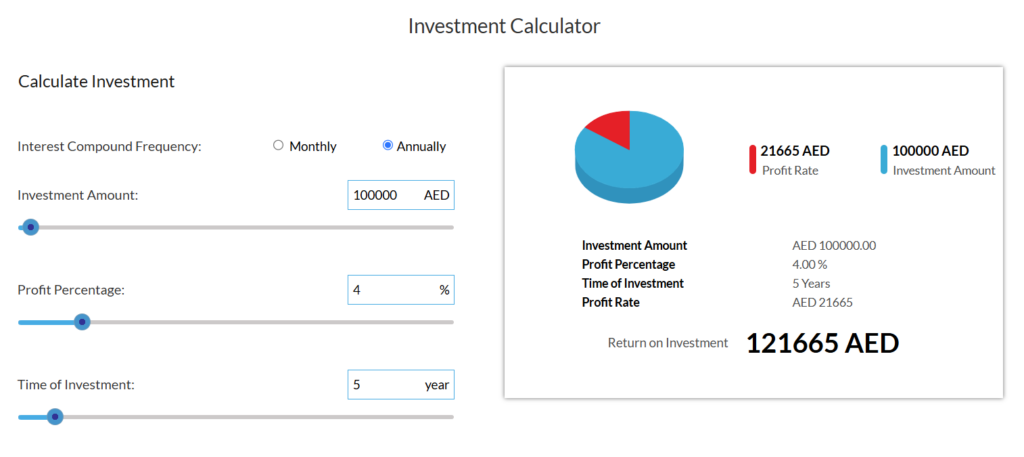

How to Use the Investment Calculator

- Investment Amount: Enter the amount you’re planning to invest. This can range from AED 1,000 to AED 10 million, depending on your financial situation.

- Profit Percentage: Input the expected return rate of your investment, which can be based on historical performance or market trends.

- Time of Investment: Choose how long you plan to keep your investment (e.g., 1 year to 60 years).

- Compound Frequency: Select the frequency at which your investment will compound—options typically include monthly or annually.

Let’s look at a real example: Say you’ve got AED 100,000 and you’re getting 4% interest yearly for 5 years. The calculator shows you could end up with AED 121,665 – that’s an extra AED 21,665 in your pocket!

How the Investment Calculator Works

The calculator is like a crystal ball for your money, helping you peek into the future of your investments. Here’s what it looks at:

- How often your money grows: Think of it like a snowball – the more often interest is added (monthly vs. yearly), the bigger it gets!

- Time is your friend: The longer you let your money work for you, the more it can grow

- Return rate matters: Higher returns sound great, but remember – they usually come with bigger risks

Consider a fixed deposit in a bank offering 4% annual interest. If you invest AED 100,000 for 5 years, with annual compounding, your return will grow steadily each year. The investment amount grows each year based on the interest earned, as shown in the table below:

| Year | Investment Amount | Profit | Total |

| 1 | AED 100,000 | AED 4,000 | AED 104,000 |

| 2 | AED 104,000 | AED 4,160 | AED 108,160 |

| 3 | AED 108,160 | AED 4,326 | AED 112,486 |

| 4 | AED 112,486 | AED 4,499 | AED 116,985 |

| 5 | AED 116,985 | AED 4,680 | AED 121,665 |

See how your money grows bigger each year? That’s the magic of compound interest at work!

Frequently Asked Questions (FAQ)

How do I use the UAE Investment Calculator?

To use the calculator, simply enter the amount you want to invest, the profit percentage, and the investment period. You can also choose how often the interest is compounded, whether monthly or annually.

What does compounding frequency mean?

Compounding frequency refers to how often your interest is added to your investment. Monthly compounding means interest is added every month, whereas annual compounding adds interest once a year. More frequent compounding generally results in higher returns.

Can the calculator be used for all types of investments?

Yes, the calculator is versatile and can be used to estimate returns for various types of investments, including fixed deposits, stocks, real estate, and mutual funds.

Is the UAE Investment Calculator accurate?

While the calculator provides a reliable estimate based on your inputs, actual returns may vary depending on market conditions and the type of investment. It’s important to consider these factors before making final decisions.

Can I change the investment period or profit percentage?

Yes, the calculator allows you to adjust the investment period and profit percentage to reflect different investment scenarios and understand how these factors affect your returns.

The UAE Investment Calculator is like having a financial advisor in your pocket – minus the fancy suit and expensive coffee meetings! Whether you’re planning for retirement, saving up for a dream home, or just want to make your money work harder, this tool helps you see what’s possible. Just a few clicks, and you’ve got a clearer picture of where your investments could take you. So what are you waiting for? Let’s make your money work as hard as you do!