Ever wondered why your money doesn’t seem to stretch as far as it used to? Welcome to the world of inflation in the UAE! While we all feel its effects on our wallets, understanding exactly how inflation impacts our daily lives can be a bit of a puzzle. That’s where the UAE Inflation Calculator comes in handy – it’s your friendly guide to tracking how prices have changed over time and what that means for your hard-earned dirhams.

Online Inflation Calculator

Think of the UAE Inflation Calculator as your financial time machine. It’s a straightforward tool that shows you what your money was worth back then versus now. Pop in 100 AED from 2008, and – surprise! – it’s actually worth about 135.18 AED today. Pretty eye-opening, right?

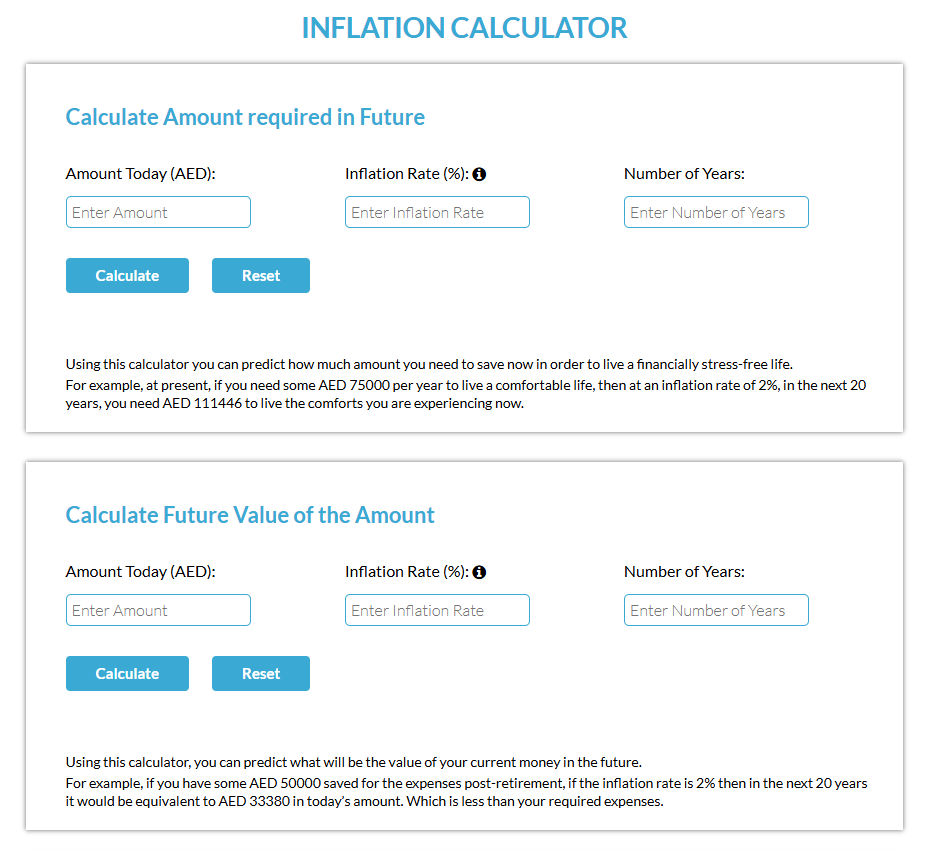

How to Use the UAE Inflation Calculator:

- Enter the original amount: For instance, input 100 AED.

- Select the start and end years: Choose the years you want to calculate, for example, 2008 to 2023.

- Click ‘Calculate’: The tool will then show you how much that money is worth today, based on inflation.

Ready to see how your money has changed over time? Give it a try:

How Does Inflation Affect Your Purchasing Power?

Here’s the deal: inflation is basically playing a long game of shrinking your money’s power. That 100 AED you had back in 2008? Well, to buy the same stuff today, you’d need about 135.18 AED. That’s a 35.18% jump in prices – ouch!

Think of inflation like a slowly deflating balloon – the amount of money stays the same, but it somehow fills up less space in terms of what you can buy. The calculator helps you see this change clearly, using real data from the UAE’s economic history.

Sample Inflation Data from 2008 to 2022:

| Year | Inflation Rate |

| 2022 | 4.83% |

| 2021 | -0.01% |

| 2020 | -2.08% |

| 2019 | -1.93% |

| 2018 | 3.07% |

| 2017 | 1.97% |

| 2016 | 1.62% |

| 2015 | 4.07% |

| 2014 | 2.35% |

| 2013 | 1.10% |

| 2012 | 0.66% |

| 2011 | 0.88% |

| 2010 | 0.88% |

| 2009 | 1.56% |

| 2008 | 12.25% |

Check out that spike in 2008 – a whopping 12.25%! And those negative numbers in 2019 and 2020? That’s when prices actually went down (thanks, pandemic!).

Why Use the UAE Inflation Calculator?

Here’s why this tool is worth bookmarking:

- Smart Budgeting: It helps you figure out how much more you might need to save for future expenses

- Savvy Investing: Want your money to grow faster than inflation? This tool helps you see if your investments are keeping up

- Salary Smarts: Perfect for when you’re discussing raises – because sometimes a “raise” barely covers inflation!

- Reality Check: Living in the UAE isn’t getting cheaper, and this calculator helps you plan ahead

Frequently Asked Questions (FAQ)

How does the inflation rate affect my savings?

Inflation erodes the value of money, meaning the purchasing power of your savings decreases over time. For example, if you keep money in a savings account with a low interest rate, it may not grow enough to offset the effects of inflation.

Can the UAE Inflation Calculator predict future inflation?

No, the calculator uses historical inflation data to show how inflation has impacted purchasing power in the past. Future inflation rates can be unpredictable and depend on various economic factors.

Is this calculator useful for budgeting?

Yes, it can help you understand how the cost of goods and services increases over time, helping you better plan your budget and save for future expenses.

Can I use this calculator for other currencies?

The UAE Inflation Calculator is designed specifically for the UAE dirham (AED). For other currencies, you would need to use different inflation calculators specific to those currencies.

What is the average inflation rate in the UAE?

Over the past 14 years (2008-2022), the average inflation rate in the UAE has been 2.2% per year, with some years experiencing significant fluctuations.

The UAE Inflation Calculator is like your financial GPS – it helps you navigate how prices change over time and what that means for your wallet. Whether you’re planning your savings, thinking about investments, or just trying to make smarter money moves, understanding inflation is key. By seeing how your money’s value shifts over time, you can make better decisions about your financial future. So go ahead, give the calculator a spin, and start making inflation-smart choices with your money!