Let’s face it – keeping track of your debts in the UAE can feel like juggling multiple balls at once. Whether you’re dreaming of buying a home, getting a new car, or taking out a personal loan, there’s one number that banks really care about: your Debt Burden Ratio (DBR). Don’t worry though – we’ll walk you through everything you need to know about calculating and managing your DBR in the UAE, making it easier to stay on top of your financial game.

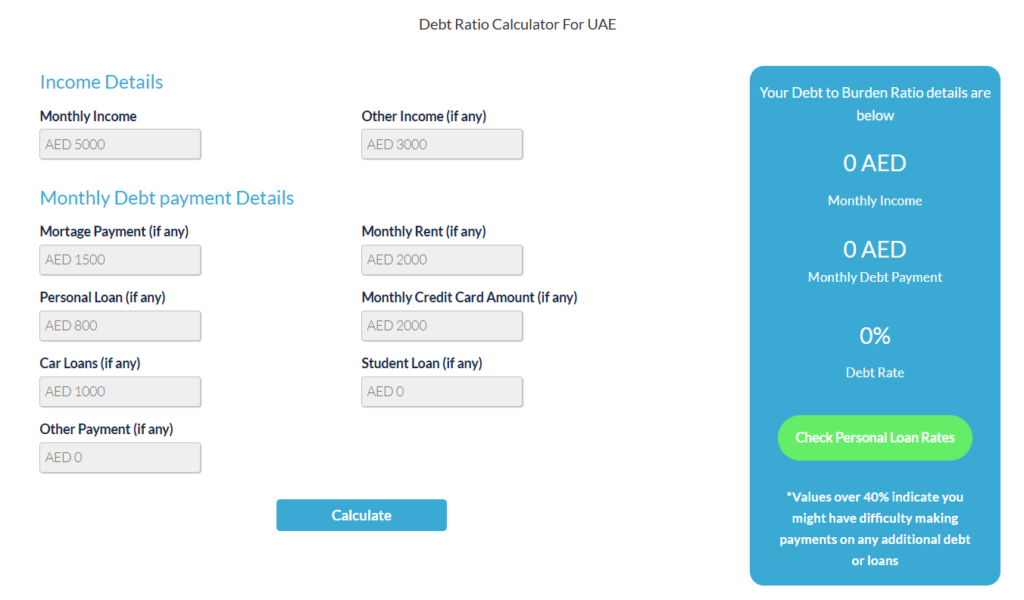

Online DBR Calculator

Think of the DBR calculator as your financial health check-up tool. Here’s what you’ll need to punch in:

- Monthly Income: Your total income from all sources.

- Other Income: Any additional income such as business profits, rental income, etc.

- Mortgage Payment: Monthly payment for your home loan, if applicable.

- Monthly Rent: If you’re renting, input your rent payment.

- Personal Loan Payment: Monthly payment for any personal loans you may have.

- Credit Card Payments: Total monthly credit card payments.

- Car Loan Payment: Monthly payments for your car loan.

- Student Loan: Monthly repayment if you have a student loan.

- Other Debt: Any additional debts you need to pay.

Once you’ve got all these numbers in place, the calculator will show you what percentage of your income is going toward debt. Pretty straightforward, right?

How DBR is Calculated and Its Purpose

Don’t let the math scare you – calculating your DBR is actually pretty simple. Here’s the formula in plain English:

DBR = (Everything you pay for debt each month ÷ Your total monthly income) × 100

Say you’re bringing in AED 5,000 monthly and paying AED 3,000 total in debts (maybe that’s your mortgage, car payment, and credit card combined). Your DBR would be:

(3,000 ÷ 5,000) × 100 = 60%

Purpose of the DBR Tool:

- Loan Eligibility: Banks in the UAE use your DBR to determine how much of your income is tied up in debt. The UAE Central Bank stipulates that your DBR should not exceed 50% if you want to be eligible for further financing.

- Financial Health: By calculating your DBR, you can assess whether you’re over-leveraged and identify areas to improve your debt management.

Why Your DBR Matters

Here’s the deal: UAE banks need to know that you’re not in over your head with debt. The UAE Central Bank has set a clear line in the sand – your DBR shouldn’t go above 50% if you want to borrow more money. Think of it as a financial traffic light – stay under 50%, and you’re in the green zone for new loans.

- Credit Risk: A high DBR indicates that a significant portion of your income is already committed to debt repayments, making it riskier for lenders to approve more loans. A lower DBR shows that you have enough income available to manage new financial obligations.

- Loan Denial: According to UAE Central Bank regulations, a DBR above 50% may lead to loan rejection. Banks will assess your ability to handle additional loans before approving your application.

Data Table Example:

| Income Source | Amount (AED) |

| Monthly Income | 5,000 |

| Other Income | 3,000 |

| Total Monthly Income | 8,000 |

| Debt Type | Monthly Payment (AED) |

| Mortgage Payment | 1,500 |

| Rent Payment | 2,000 |

| Personal Loan Payment | 800 |

| Credit Card Payments | 2,000 |

| Car Loan Payments | 1,000 |

| Total Monthly Debt | 7,300 |

DBR Calculation:

DBR=(7,3008,000)×100=91.25%\text{DBR} = \left( \frac{7,300}{8,000} \right) \times 100 = 91.25\%DBR=(8,0007,300)×100=91.25%

In this case, your DBR would be 91.25% – yikes! That’s way too high, and you’d probably need to do some financial housekeeping before taking on any new loans.

Frequently Asked Questions (FAQ)

How often should I check my DBR?

It’s a good idea to check your DBR regularly, especially before applying for new loans. This will help you assess whether you’re in a good financial position to take on additional debt.

What is the maximum DBR allowed for loan approval in the UAE?

According to the UAE Central Bank, your DBR should not exceed 50% to qualify for most loans. A higher ratio may result in loan rejection.

How can I improve my DBR?

To lower your DBR, focus on paying off high-interest debts like credit cards, reduce your overall debt, and increase your income through side businesses or investments.

Does a high DBR affect my credit score?

Yes, a high DBR can negatively impact your credit score. It indicates to lenders that you may already be struggling to manage your debt, which could make it harder to get approved for future loans.

Can the DBR calculator help with all types of loans?

The DBR calculator is useful for calculating your eligibility for personal loans, mortgages, car loans, and any type of financing that requires debt evaluation.

Think of your DBR as your financial fitness score in the UAE. Just like maintaining a healthy lifestyle, keeping your DBR in check takes some work, but it’s totally worth it. The UAE DBR Calculator makes it easy to stay on top of your numbers and know exactly where you stand. Remember, a lower DBR isn’t just a number – it’s your ticket to more financial opportunities down the road. So take a few minutes to crunch those numbers and set yourself up for success. Your future self will thank you!