Hey there! Let’s talk about one of the most powerful tools in your financial toolkit – compound interest. If you’re in the UAE and looking to make your money work harder for you, a compound interest calculator can be your best friend. Whether you’re dreaming of that dream home or planning for a comfortable retirement, understanding how your investments can grow over time is crucial.

Online Compound Interest Calculator

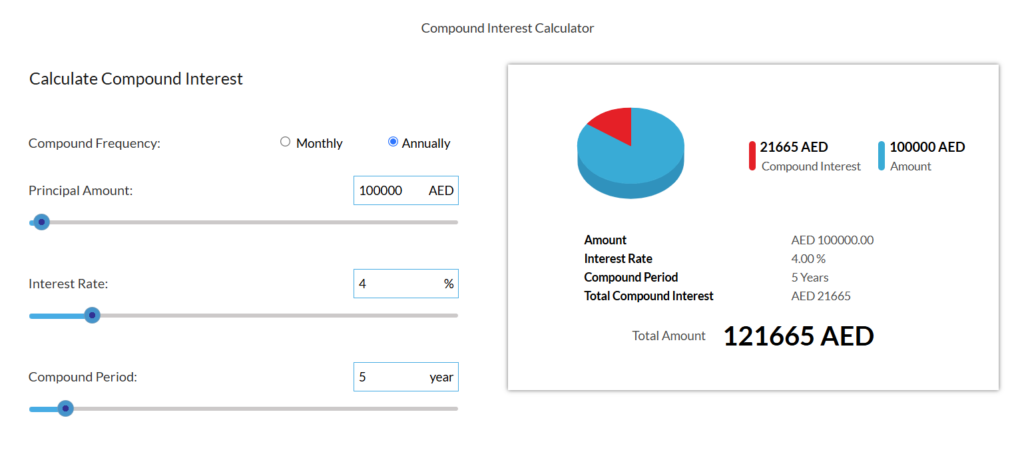

It’s pretty straightforward! Here’s what you’ll need to plug in:

- Principal Amount: The initial investment or deposit.

- Interest Rate: The annual interest rate (expressed as a percentage).

- Investment Period: How long you plan to invest the money.

- Compounding Frequency: Choose from daily, monthly, or annually, based on how often interest is added to your investment.

Pop these numbers into the calculator, and voilà – you’ll see how much your money could grow!

How the Calculator Works and Why It Matters

Ever wondered how compound interest actually works? It’s like a snowball effect – your initial investment earns interest, and then that interest starts earning interest too! Here’s the fancy formula if you’re curious:

A=P(1+rn)ntA = P \left(1 + \frac{r}{n}\right)^{nt}A=P(1+nr)nt

Don’t worry if math isn’t your thing! Here’s what those letters mean:

- A = what your investment will be worth in the future

- P = how much you’re starting with

- r = your yearly interest rate (in decimal form)

- n = how many times interest is added per year

- t = how many years you’re investing for

Why Use the UAE Compound Interest Calculator?

Trust me, this tool is a game-changer! Here’s why:

- Helps with Long-Term Planning: It allows you to visualize how your money will grow over time, making it easier to plan for long-term goals.

- Compares Investment Options: You can test different investment scenarios by adjusting interest rates, compounding frequency, and time periods.

- Ensures Accurate Projections: It takes the guesswork out of calculations, helping you make informed decisions about where and how to invest your money.

Below is an illustration of how much your investment might grow after 5 years:

| Principal (AED) | Interest Rate | Compounding Frequency | Future Value (AED) |

| 50,000 | 6% | Annually | 66,900 |

This example shows that AED 50,000 invested at 6% interest annually for 5 years will grow to AED 66,900. The additional AED 16,900 is earned purely through compound interest.

FAQ: Frequently Asked Questions

What is compound interest?

Compound interest is interest that is calculated on both the initial principal and the accumulated interest from previous periods. This leads to exponential growth over time.

How often can interest compound?

The interest can compound annually, monthly, or daily. The more frequently the interest compounds, the higher the potential returns.

Can I adjust the input parameters?

Yes, you can adjust the principal amount, interest rate, investment duration, and compounding frequency to see how each affects your returns.

How accurate is the calculator?

The calculator provides an accurate estimate based on the inputs you provide. However, real-world results may vary depending on market conditions and any changes in interest rates.

How can I use the calculator for planning?

You can use the calculator to plan for future goals like saving for a home, retirement, or any other long-term financial goal. By visualizing how your investment will grow, you can make more informed decisions.

Look, growing your wealth doesn’t have to be complicated. A UAE Compound Interest Calculator makes it super easy to see how your money can work for you over time. The sooner you start playing around with these numbers, the better equipped you’ll be to make smart financial decisions. So why not give it a try? Your future self will thank you for taking this step toward better financial planning.