Are you looking to save smartly while enjoying attractive benefits? Opening a FAB (First Abu Dhabi Bank) savings account could be the perfect choice for you! Formed in 2017 through the merger of the National Bank of Abu Dhabi (NBAD) and First Gulf Bank (FGB), FAB is now the largest bank in the UAE, offering a variety of savings accounts tailored to meet different needs and preferences.

In this guide, we will cover everything you need to know about opening a FAB savings account in 2024, including the types of accounts available, the application process, and tips to enhance your banking experience.

Why Choose FAB Savings Account?

FAB is renowned for its customer-centric services and competitive interest rates. With a FAB savings account, you’ll have access to features like free debit cards, online banking, and more. Plus, there’s no monthly fee for many of their savings accounts, making it an affordable choice for anyone looking to grow their savings.

Types of FAB Savings Accounts

Before diving into the application process, let’s take a look at some popular FAB savings account options:

1. FAB iSave Account:

- Monthly Fee: No fee

- Interest Rate: Higher interest rates compared to standard accounts

- Withdrawals: Unlimited withdrawals from FAB ATMs

- Benefits: Ideal for those who want to maximize their savings without any charges.

2. FAB Personal Savings Account:

- Monthly Fee: No fee

- Interest Rate: Competitive rates with higher earning potential based on account balance

- Benefits: Unlimited access to FAB ATMs and earning rewards on maintaining a high balance.

3. FAB Personal Call Savings Account:

- Monthly Fee: AED 10

- Minimum Balance: AED 5,000

- Benefits: Higher interest rate compared to regular savings accounts, but comes with a limitation on ATM withdrawals.

4. FAB Etihad Guest Elite Savings Account:

- Monthly Fee: AED 50

- Minimum Balance: AED 25,000

- Benefits: Earn Etihad Guest Miles on transactions, free debit card, and additional perks like travel insurance.

Steps to Open a FAB Savings Account

Opening a FAB savings account is simple and can be done either through the FAB mobile app or by visiting a branch. Here’s how:

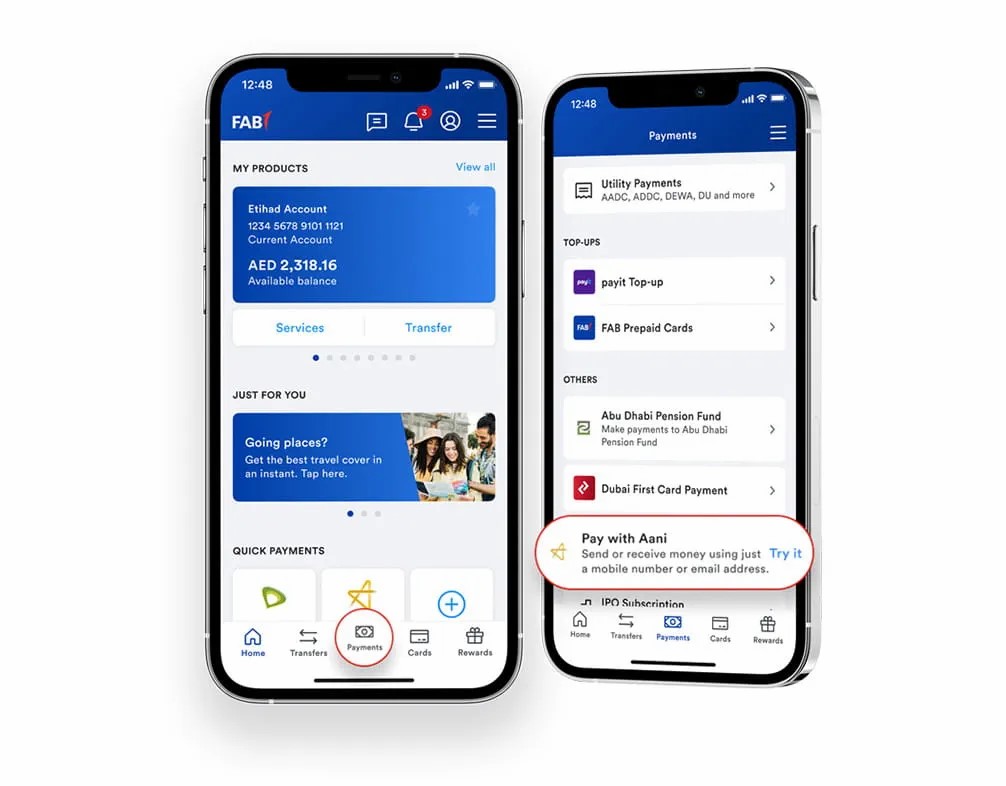

Method 1: Using the FAB Mobile App

1. Download the App:

- Visit the App Store or Google Play Store to download the FAB mobile app.

2. Prepare Your Emirates ID:

- You’ll need your Emirates ID for verification.

3. Register Your Details:

- Open the app and enter your registered mobile number or email address.

4. Complete the Application:

- Fill in your personal information in the provided form.

5. Submit Your Application:

- After reviewing your information, submit the application. You’ll receive approval within 24 hours.

6. Account Access:

- Once your account is created, set up your username and secure password to start enjoying online banking features!

Method 2: Visiting a Branch

If you prefer the traditional route or need assistance, visiting a FAB branch is a great option.

1. Gather Required Documents:

- Emirates ID or passport (valid for at least six months)

- Income proof or salary certificate

- Completed FAB Bank Account Opening Form (available at the branch)

2. Visit the Branch:

- Go to your nearest FAB branch. Make sure you have all your documents ready.

3. Open Your Account:

- Present your documents to the bank representative, who will assist you in completing the account opening process.

4. Account Activation:

- After your application is processed, your account will be activated, and you’ll receive your debit card and account details.

Tips for Managing Your FAB Savings Account

- Set Savings Goals: Having clear goals can help you stay focused on your saving habits. Whether it’s for a vacation, a new car, or an emergency fund, knowing what you’re saving for can motivate you to keep your account topped up.

- Utilize Online Banking: Take advantage of FAB’s online banking features. It’s not only convenient but allows you to monitor your account, make transfers, and check your balance anytime, anywhere.

- Watch for Promotions: FAB often runs promotions that could enhance your banking experience. Keep an eye out for offers related to interest rates, rewards, or fee waivers.

- Consult Financial Advisors: If you’re unsure about which account suits your needs best, don’t hesitate to ask a bank representative for guidance. They can provide valuable insights tailored to your financial situation.

Opening a FAB savings account in 2024 is a smart move for anyone looking to enhance their financial stability while enjoying excellent banking services. Whether you choose to apply via the mobile app or visit a branch, the process is designed to be straightforward and user-friendly. By selecting the right account type and utilizing the available features, you can make the most of your savings and enjoy the many benefits FAB has to offer. So, why wait? Start your savings journey with FAB today!