Hey there! Looking to grow your money but not sure where to start? Sarwa might be just what you’re looking for. Whether you’re completely new to investing or just want to switch things up, Sarwa makes the whole process pretty straightforward. Let me walk you through everything you need to know about getting started.

What Is Sarwa?

Before we jump into the nitty-gritty, let’s talk about what Sarwa actually is. Think of it as your friendly neighborhood investment platform, but digital! They’ve taken all the complicated stuff about investing and made it super simple. Whether you’re the play-it-safe type or ready to take on more risk, Sarwa’s got you covered with different investment options. Plus, they work with both individual investors like you and me, and bigger corporate players.

Types of Sarwa Accounts

Sarwa’s pretty flexible with their account options:

- Individual Accounts: Perfect if you’re flying solo on your investment journey

- Corporate Accounts: For businesses with deeper pockets (we’re talking about $250,000 minimum)

- Joint Accounts: Great for couples or family members who want to invest together

- Multiple Accounts: Want more than one? No problem! (Though heads up – you can only have one Sarwa Trade account)

Steps to Open an Individual Sarwa Investment Account

Ready to dive in? Here’s how to get your individual account up and running:

Step 1: Register on the Website or App

Head over to Sarwa’s website or grab their app. They’ll ask you some questions about your money goals and how you feel about risk – kind of like a financial personality quiz!

Step 2: Submit the Required Documents

Time for the paperwork (don’t worry, it’s all digital):

- Proof of identity (passport, national ID, etc.)

- Proof of address (utility bill or bank statement)

Just make sure everything’s clear and up-to-date – it’ll save you time in the long run.

Step 3: Account Approval

Sit tight while Sarwa checks everything out. It usually takes a few business days – maybe time to start planning what to do with your future millions? (Just kidding!)

Step 4: Fund Your Account

Once you’re approved, it’s time to fund your account. The minimum to get started is usually $2,500 – think of it as your investment starter pack!

Opening a Corporate Account

If you’re looking to invest for your business, things work a bit differently. You’ll need:

- $250,000 for investing in model portfolios

- $500,000 for creating a bespoke portfolio

if you want something custom-made Interested? Just drop them a line at [email protected], and they’ll sort you out.

How to Open Additional Accounts

Got the investing bug? Adding another account is super easy:

- Open the Sarwa app, navigate to your Invest Dashboard.

- Scroll down to “Create a new account.”

- Follow the prompts to set up your new account, and you’re ready to fund it.

Keep in mind that for joint accounts, you’ll need to reach out to Sarwa directly.

Opening a Joint Account

Investing with your better half or family member? Here’s the deal:

- Both parties need to register on the Sarwa website or app.

- Upload the necessary documents.

- Send an email to [email protected], with both account holders’ details, to specify the account type (Joint Invest, Joint Save, and whether you prefer a Halal or conventional investment approach).

Note that joint accounts are not supported for Sarwa Trade, so keep that in mind when making your decision.

Why Choose a Joint Account?

Joint accounts can be pretty handy! Here’s why:

- Easier management: Instead of managing multiple individual accounts, you can manage everything in one shared account.

- Lower costs: Combining assets might allow you to qualify for lower-priced investment plans.

- Shared access: Both account holders can access the account, making it easier to fund and withdraw from the account as needed.

- Estate planning: In the unfortunate event of a death, the joint account holder automatically assumes full ownership of the account.

Sarwa’s Referral Program

Love Sarwa? Spread the love! Here’s their referral program in a nutshell:

- Share your unique referral code with your friend.

- They must meet the minimum investment requirement (usually $2,500) within 90 days of opening their account.

- Once the requirement is met, both you and your friend will receive a bonus in your Sarwa accounts.

Important Note: Referral bonuses must stay in the account for 90 days, and joint account holders are not eligible for the bonus. Always check the latest terms and conditions for special bonus campaigns.

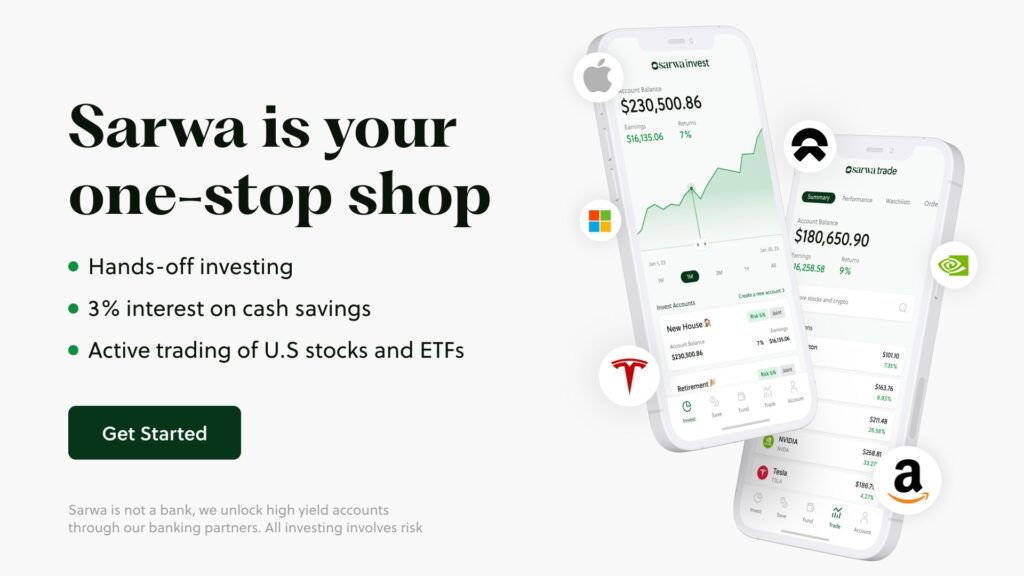

Sarwa’s Investment Options

Once you’re all set up, you’ve got options! From playing it safe to going all in, Sarwa’s got different risk levels:

- Risk 1: Steady, low-risk growth, starting from $10,162 in Year 1 to $12,721 in Year 15.

- Risk 6: Higher risk but higher returns, growing from $10,556 to $22,517 in 15 years.

- US Bonds: A more stable investment, growing from $10,438 to $19,008 in 15 years.

- SPY: A more aggressive portfolio with significant growth, starting at $10,992 and reaching $41,319 in 15 years.

Want to learn more about Sarwa’s investment projections? Take a look at the video below

Want to compare Sarwa’s investments with other platforms? We’ve put together a comparison sheet here.

See? Getting started with Sarwa isn’t rocket science! Whether you’re investing solo, with a partner, or for your business, they’ve made it pretty painless to get going. The hardest part might just be deciding how much to invest! Ready to take that first step toward growing your wealth? Follow this guide, and you’ll be investing before you know it. Happy investing!