Managing finances as an expat or resident in the UAE is no small feat, and for many, the Ratibi Salary Card has become an invaluable tool in making things simpler. If you or someone you know relies on a Ratibi Card, keeping an eye on the balance can help you stay in control of your spending and make sure you’re on top of your financial goals.

Let’s walk through everything you need to know about the Ratibi Card and the easy, stress-free ways to check your balance. From personal anecdotes to practical tips, this guide will equip you with all the info you need!

What is a Ratibi Salary Card, and How Does it Work?

The Ratibi Salary Card is a prepaid payroll card issued by the First Abu Dhabi Bank (FAB). It’s primarily aimed at employees in the UAE who might not have a traditional bank account, especially those earning salaries of AED 5,000 or less. Many employees in the UAE use Ratibi cards for receiving salaries, accessing cash, and making payments. The card is part of the UAE’s Wages Protection System (WPS), which ensures that workers get paid on time and without complications.

Think of it like this: if a traditional bank account is a full-blown toolbox, the Ratibi Card is a handy multi-tool—it might not have all the bells and whistles, but it’s incredibly practical for day-to-day essentials. This card allows employees to do things like withdraw money, remit funds internationally, and make bill payments—all without the need for a full bank account.

Why You Should Keep Track of Your Ratibi Balance

Checking your balance is more than just a habit; it’s a smart financial move. Knowing how much you have available can help you plan expenses, avoid unnecessary overdrafts, and save for future goals. Imagine logging into your balance and realizing you have just enough left to send a little extra back home or treat yourself to something special—that’s the kind of control that checking your balance regularly can give you.

In Dubai, where expenses can add up quickly, keeping tabs on your money can help you feel in control, especially if you have family to support or bills to manage. So let’s look at some quick, straightforward ways to stay on top of your Ratibi balance.

Quick Ways to Check Your Ratibi Card Balance

1. Online Balance Check via FAB Website

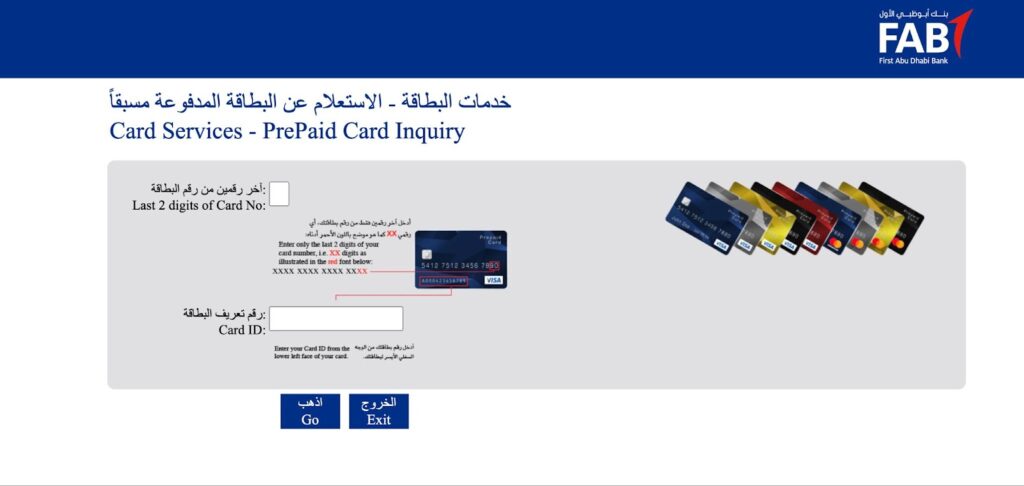

Checking your balance on the FAB website is one of the most convenient options. All you need is a few details from your card and internet access. Here’s how you do it:

- Step 1: Open your browser and go to the First Abu Dhabi Bank website.

- Step 2: On the homepage, navigate to the “Prepaid Cards” section, then select “Ratibi Prepaid Card“

- Step 3: Scroll down and click on “Ratibi Prepaid Card Balance Enquiry.” A pop-up message will inform you that you’re leaving the FAB website. Just click “Follow Link.”

- Step 4: You’ll be taken to the Prepaid Card Inquiry page. Here, enter the last two digits of your card number and your Card ID.

Once you’ve entered this info, your balance should appear on the screen. Checking online is a lifesaver when you’re at home or at work and can access a computer.

2. Checking Your Balance on the Go with the Payit Mobile App

If you’re always on the move, the Payit mobile app by FAB is another fantastic option. Many Ratibi Cardholders swear by it for its convenience. Here’s a quick walkthrough:

- Step 1: Download the Payit app from your app store (Play Store or App Store)if you haven’t already.

- Step 2: Open the app and follow the instructions to register. Once registered, you can link your Ratibi Card.

- Step 3: After linking, you can check your balance directly in the app whenever you need.

The Payit app is especially handy if you want to transfer funds internationally or pay bills, as it integrates smoothly with your Ratibi Card.

3. Balance Check at Any FAB ATM

Another easy way to check your balance, especially if you prefer a physical reminder, is at any FAB ATM across the UAE. Simply insert your Ratibi Card, select “Balance Enquiry,” and view your balance on the screen.

I remember helping a colleague set this up once. He was new to the Ratibi system and felt reassured when he saw that his balance was just a few taps away. Sometimes, it’s nice to know you have that in-person option if online or app-based methods aren’t working for you.

Beyond Checking Your Balance: Managing Your Ratibi Card Smartly

Set Up Free Salary Alerts

Did you know you can get free SMS alerts every time your salary is deposited? It’s a simple step but can be incredibly helpful, especially if you’re tracking your income to the last dirham. Just contact FAB’s customer service or set this up via the Payit app to get notifications that keep you informed.

Plan Monthly Expenses

Having a clear idea of your balance can help you budget more effectively. For instance, after checking your balance, you could decide to set aside AED 200 for bills, AED 100 for savings, and the remainder for everyday expenses. Simple strategies like these, where you break down your budget, can go a long way in managing finances effectively.

Send Money Home with Ease

One of the greatest benefits of the Ratibi Card is that you can use it to remit money home to family with ease. Checking your balance first ensures you have enough to cover the transfer and still have enough for your own expenses. Many users find this balance check-before-transfer routine essential in managing both family obligations and personal finances.

Overcoming Common Challenges with Ratibi Card Balance Checks

Sometimes, tech hiccups happen. Here’s a quick troubleshooting guide for the most common issues:

- Incorrect Details: Make sure to double-check your Card ID and card number to avoid input errors when checking your balance online.

- Network Issues: If you can’t load the FAB website or Payit app, try switching to a stronger network or visiting an ATM to get the info you need.

- Persistent Issues: If none of the methods work, FAB customer service is available to help you troubleshoot, so don’t hesitate to reach out.

The Benefits of Checking Your Ratibi Balance Regularly

Regularly checking your balance isn’t just about knowing how much is left on your card; it’s a way to improve your financial wellness. Here are a few key benefits:

- Better Control Over Finances: Knowing your balance means you can make informed spending decisions. No more wondering if you have enough for a last-minute purchase.

- Avoiding Unexpected Expenses: Regular balance checks keep you informed, so you’re not caught off guard by sudden charges or fees.

- Saving and Remittance Planning: If you send money home, checking your balance helps you allocate the right amount for family needs while ensuring you still have enough to cover your own expenses.

FAQs

How can I check my Ratibi Salary Card balance?

To check your Ratibi Salary Card balance, visit the FAB website, select “Prepaid Cards,” and go to “Ratibi Card Balance Enquiry.” Enter your Card ID and the last two digits of your card number. Alternatively, you can check via the Payit app or any FAB ATM for instant access.

Can I use my Ratibi Card to send money internationally?

Yes, you can use your Ratibi Card to send money internationally. It allows transfers to over 200 countries, making it a convenient option for remittances without the need for a bank account. Simply use your card through the Payit app or any supported money transfer service.

Are there fees associated with the Ratibi Card?

The Ratibi Card has no monthly fees or charges for cardholders. However, certain services like ATM withdrawals outside of the UAE or foreign currency transactions may incur fees. Always check the terms or consult with the bank for detailed fee information on specific services.

How do I activate my Ratibi Card?

To activate your Ratibi Card, simply link it to the Payit mobile app. Follow the app’s instructions to complete the activation process. Once activated, you can start using the card for withdrawals, payments, and other services.

The Ratibi Card simplifies financial transactions for UAE residents, especially those without traditional banking access. Making it a habit to check your balance regularly—whether on the website, through the Payit app, or at an ATM—puts you in control of your finances in a city like Dubai, where managing expenses is key.

This simple routine helps you avoid financial surprises and allows you to plan and optimize your spending and saving. For more ways to stay organized, check out our 2025 UAE Public Holiday Calendar for upcoming breaks, or learn about DU Number & MSISDN Deletion to keep your mobile accounts streamlined and secure.