The UAE is one of the most attractive destinations for expatriates looking to buy property. With its thriving economy, modern infrastructure, and luxurious living options, it’s no wonder that many expatriates are keen on investing in real estate here. However, property ownership laws for expatriates in the UAE differ depending on the emirate. In this article, we’ll walk you through how to buy property in the UAE as an expatriate, covering the various regulations and ownership options across different emirates.

Understanding the Legal Framework

Before diving into the process of buying property in the UAE, it’s important to understand the legal framework. In the past, property ownership by expatriates was restricted in certain areas, but with recent changes, the landscape has evolved. Today, expatriates can own property in specific designated areas across various emirates under different ownership systems.

These changes have opened up new opportunities for foreign investors and expatriates looking to settle or invest in the UAE’s thriving real estate market. However, it’s crucial to familiarize yourself with the regulations in each emirate to ensure a smooth and informed purchasing process.

Property Ownership in Abu Dhabi

Abu Dhabi, the capital of the UAE, has its own set of regulations regarding expatriate property ownership. Under Law No. 19 of 2005, expatriates are allowed to own residential properties, but not land. The ownership options available to expatriates in Abu Dhabi are:

- Ownership: Expatriates can own residential units such as apartments and villas for a period of 99 years. This allows full control over the property, but land ownership is excluded.

- Musataha: This system allows expatriates to own the property for 50 years, with the option to renew it for another 50 years. The Musataha contract grants the holder the right to enjoy, construct, and alter the property within the given period.

- Usufruct: Under this agreement, expatriates can own the right to use a residential unit for 99 years. However, they cannot make changes to the property itself.

- Long-term Lease: In Abu Dhabi, expatriates can also opt for a long-term lease agreement for a period of at least 25 years.

Designated Areas for Ownership in Abu Dhabi

There are certain areas where expatriates are permitted to buy property. These include popular areas such as Yas Island, Saadiyat Island, Reem Island, Al Raha Beach, and more. If you’re planning to buy in Abu Dhabi, ensure that the property falls within one of these designated areas.

Recent Changes to Abu Dhabi’s Real Estate Laws

In April 2019, the Abu Dhabi Real Estate Law was amended, allowing non-UAE nationals to acquire full ownership rights in certain investment zones. This amendment made it easier for expatriates to own properties in areas like Al Raha Beach and Saadiyat Island, among others. If you’re considering investing in Abu Dhabi’s real estate market, understanding the average salary in Abu Dhabi can provide valuable insights into the city’s economic landscape and help you make informed decisions about your investment or relocation plans.

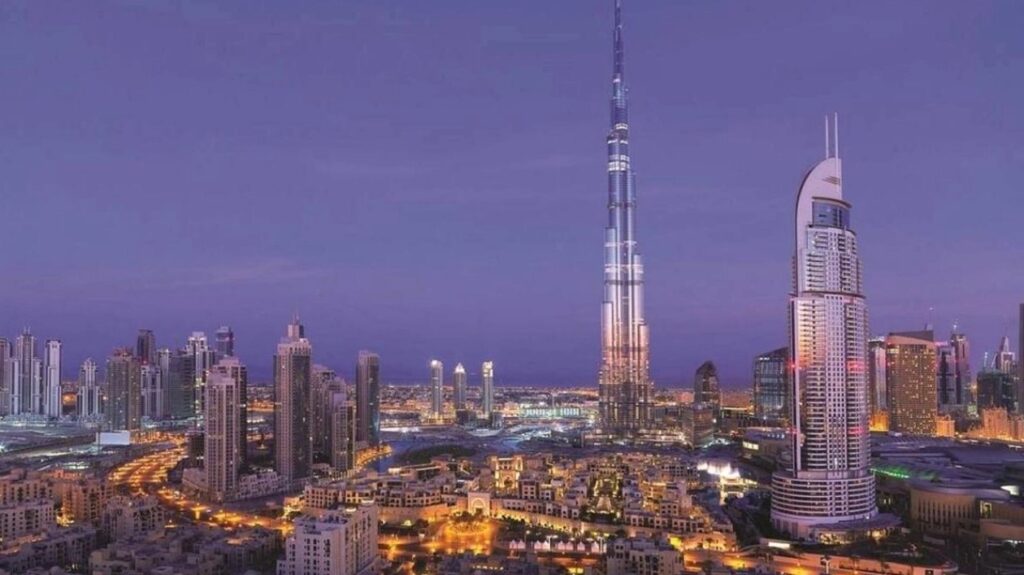

Property Ownership in Dubai

Dubai is the UAE’s most famous emirate and is known for its iconic skyline, luxury properties, and vibrant lifestyle. Expatriates have more flexibility in Dubai when it comes to property ownership, particularly in designated freehold areas.

- Freehold Areas: In Dubai, expatriates can acquire freehold properties in designated areas without any restrictions. Freehold ownership grants expatriates complete ownership of the property, including the right to sell, lease, or mortgage the property.

- Usufruct and Leasehold: For properties outside the freehold areas, expatriates can acquire usufruct or leasehold rights, typically for up to 99 years.

No Age Limit

Unlike some other countries, there is no age limit for expatriates buying property in Dubai, making it an attractive option for people of all ages.

Important Points for Buyers

When purchasing property in Dubai, ensure you consult with the Dubai Land Department (DLD) or a real estate agency for up-to-date regulations and the specific areas where foreign ownership is allowed. You’ll also need to consider additional fees such as registration costs, maintenance fees, and potential taxes. To make informed decisions, it’s also essential to understand the average salary in Dubai, which provides valuable context about the city’s economic conditions and can help you assess affordability and investment potential in the region.

Property Ownership in Sharjah

Unlike Abu Dhabi and Dubai, Sharjah has more restrictions on expatriates buying property. Expatriates are not allowed to own property in Sharjah, but they can acquire usufruct rights for a period of up to 100 years. However, these rights are only granted in specific areas that have been approved by the Government of Sharjah.

- Usufruct Rights: This type of agreement allows expatriates to use the property for a set period, but they are not allowed to make significant changes or sell the property.

- Approval from the Ruler of Sharjah: To acquire usufruct rights in Sharjah, expatriates need special approval from the Ruler of Sharjah, and the property must fall within designated areas for foreign ownership.

- Average Salary in Sharjah: Understanding the average salary in Sharjah can help expatriates gauge the city’s economic environment and assess the financial feasibility of acquiring usufruct rights or renting property in approved areas.

Key Considerations for Expatriates

Buying property in the UAE as an expatriate can be an exciting opportunity, but it’s essential to understand the legal landscape before making a decision. Here are a few key considerations to keep in mind:

- Consult Legal Experts: The property laws in the UAE can be complex and vary by emirate. It’s a good idea to seek legal advice or consult with a reputable real estate agent before proceeding with your purchase.

- Know the Costs: In addition to the cost of the property itself, be prepared for additional fees such as registration fees, agency commissions, and maintenance costs. The total cost of buying property in the UAE can be significant, so it’s essential to budget accordingly.

- Visa and Residency Status: While owning property in the UAE doesn’t automatically grant you residency, certain ownership rights in designated freehold areas may allow expatriates to apply for a residency visa.

- Financing Options: Mortgages are available for expatriates, but the terms and interest rates can vary. Typically, expatriates will need to provide a larger down payment compared to UAE nationals.

- Investment Areas: Always check whether the property you’re interested in is located within an area that permits foreign ownership. Some areas in Abu Dhabi, Dubai, and Sharjah are specifically designated for expatriate property ownership.

FAQs

Can expatriates own property in the UAE?

Yes, expatriates can own property in designated areas across various emirates like Dubai and Abu Dhabi, with ownership rights varying by emirate. Some areas offer full ownership, while others have leasehold or usufruct agreements.

Are there restrictions on property ownership in Abu Dhabi?

Expatriates can own residential units in Abu Dhabi but cannot own land. Ownership options include 99-year contracts, Musataha, and usufruct agreements, with property available in designated areas like Yas Island and Saadiyat Island.

Can expatriates buy property in Sharjah?

Expatriates cannot own property in Sharjah but may acquire usufruct rights for up to 100 years in approved areas. Special approval from the Ruler of Sharjah is required for these agreements.

Do expatriates need legal advice to buy property in the UAE?

Yes, expatriates should consult legal experts or real estate agents due to the complexity of ownership laws, fees, and documentation requirements across different emirates. Legal advice ensures a smooth and informed purchasing process.

The UAE offers a range of opportunities for expatriates to buy property, especially in high-demand areas like Dubai and Abu Dhabi. Understanding the different types of ownership options available, as well as the specific regulations for each emirate, is crucial for making a sound investment.

Similarly, knowing how sick leave works in the UAE and understanding compensation for termination of employment are essential for navigating workplace policies and protecting your rights as an employee. By consulting with experts, doing thorough research, and staying informed on both professional and personal matters, expatriates can make confident decisions and fully enjoy the opportunities the UAE offers.