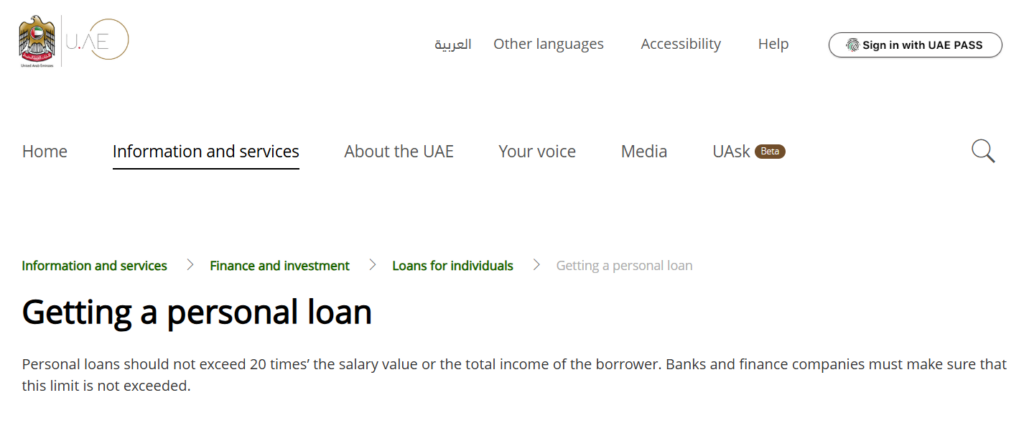

The UAE is a land of opportunities, attracting professionals from across the globe with its dynamic economy and lifestyle. However, the rising cost of living in this region often leads residents to explore personal loans as a way to manage financial needs, whether for emergencies, investments, or even dream vacations. If you’re considering a personal loan, understanding the income-based guidelines can make the process smooth and hassle-free. Here’s everything you need to know to navigate personal loan eligibility in the UAE.

What is a Personal Loan?

A personal loan is essentially a credit facility provided by banks to individuals, allowing them to borrow against future income. These loans are typically unsecured, meaning they don’t require collateral, but they do come with responsibilities—repayment terms must be honored to avoid financial pitfalls. Failure to manage repayments can lead to penalties, increased interest rates, or even legal complications. Therefore, it’s crucial to fully understand the terms and conditions before committing to a loan.

Key Factors Influencing Loan Eligibility

1. Your Monthly Income

Your income is the most critical factor in determining your eligibility for a personal loan. Most banks in the UAE have minimum salary requirements, typically starting from AED 4,000 to AED 10,000, depending on the bank. Here’s an overview of some popular banks and their minimum salary requirements:

| Bank | Maximum Loan Amount | Minimum Salary Requirement |

| Emirates Islamic Personal Finance | AED 2 million | AED 5,000 |

| Ajman Bank Goods Murabaha | AED 1 million | AED 6,500 |

| Mashreq Personal Loan for Expats | AED 1 million | AED 7,000 |

| Emirates NBD (No Salary Transfer) | AED 500,000 | AED 10,000 |

2. Debt Burden Ratio (DBR)

The UAE Central Bank mandates that your Debt Burden Ratio (DBR)—the percentage of your income already committed to loans—must not exceed 50%.

How to calculate DBR:

(Totalloaninstallments+5(Total loan installments + 5% of credit card limit) ÷ Total monthly income(Totalloaninstallments+5 x 100

For example:

- Monthly salary: AED 10,000

- Total loan installments: AED 1,500

- Credit card limit: AED 20,000

DBR = 1,500+(20,000×0.05)1,500 + (20,000 x 0.05)1,500+(20,000×0.05) ÷ 10,000 = 25%

3. Credit Score

Managed by the Etihad Credit Bureau, your credit score ranges between 300 and 900. A score above 600 improves your chances of loan approval, while scores below 400 often lead to rejections. To check your score, you can obtain a report from the bureau for AED 100.

Required Documents for a Personal Loan

The documentation process varies for expats, UAE nationals, salaried employees, and self-employed individuals. Here’s a checklist:

For All Applicants:

- Emirates ID

- Passport and visa copy

- Proof of address

For Salaried Employees:

- Salary certificate

- Last 3 months’ bank statements

- Salary transfer certificate (if applicable)

For Self-Employed Individuals:

- Trade license

- Memorandum of association

- Last 6 months’ bank statements

Tips to Improve Loan Approval Chances

- Ensure You Meet the Eligibility Criteria: Always check the minimum salary and other requirements of the bank you’re applying to.

- Maintain a Good Credit Score: Pay bills on time and avoid defaulting on existing loans.

- Keep Your DBR Below 50%: Limit unnecessary borrowing and pay off smaller loans before applying.

- Choose an Affordable Loan Amount: Borrow only what you can comfortably repay.

Flat vs. Reducing Interest Rates

Understanding the interest rate structure is crucial.

- Flat Rate: Remains constant throughout the loan tenure.

- Reducing Rate: Starts higher but decreases over time, calculated on the outstanding balance.

For example, if you prefer predictable monthly payments, go for a flat rate. If you expect to pay off your loan early, a reducing rate may save you money.

Frequently Asked Questions (FAQs)

What is the minimum salary required for a personal loan in the UAE?

Most UAE banks require a minimum salary between AED 4,000 and AED 10,000, depending on the bank. For example, Emirates NBD requires a minimum salary of AED 10,000.

How is the Debt Burden Ratio (DBR) calculated?

DBR is calculated by dividing total loan installments and 5% of your credit card limit by your monthly income. The UAE Central Bank mandates that DBR should not exceed 50%.

What is a good credit score for loan approval?

A credit score above 600 improves your chances of approval, while scores below 400 may lead to rejection. Scores are managed by the Etihad Credit Bureau.

What documents are required for a personal loan application?

Required documents include your Emirates ID, passport, visa, and proof of address. Salaried employees must also provide a salary certificate and bank statements.

Personal loans in the UAE can be a helpful financial tool when used responsibly. To secure the right loan, understand income guidelines, maintain a good credit score, and manage debt effectively. Check out our guides on How to Apply for DIB Personal Loan and Taking a Loan Balance from DU for helpful tips. Always compare options across banks for the best interest rates and repayment terms. Borrow wisely, and ensure your repayment plan aligns with your financial capacity for a stress-free journey.