Hey there! Remember when VAT hit the UAE scene back in January 2018? It was quite the change, wasn’t it? While the standard 5% rate might seem straightforward, we all know calculating VAT can sometimes make your head spin – especially when you’re trying to figure out if that price tag includes VAT or not. Good news though! There’s a super handy UAE VAT calculator that makes the whole process a breeze. Let’s dive into how it works!

Online VAT Calculator

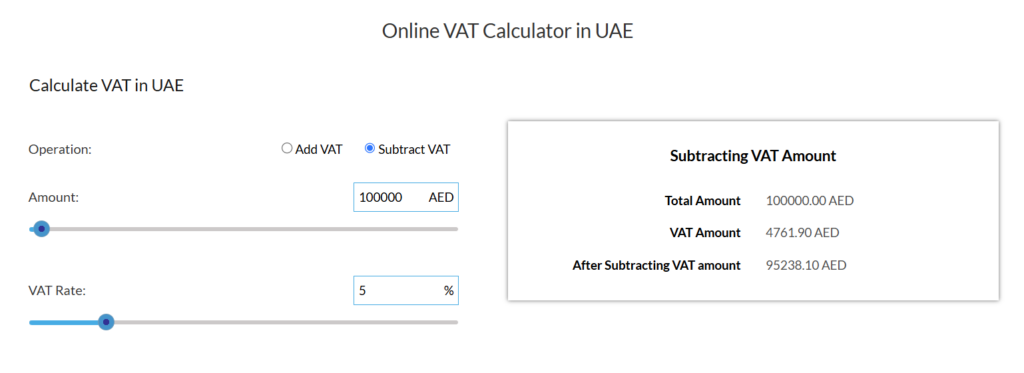

It’s really simple to use – here’s all you need to do:

- Enter the Amount: Input the price either as a net price (excluding VAT) or a gross price (including VAT).

- Select VAT Rate: The VAT rate is preset to 5%, the standard rate in the UAE. However, if needed, you can adjust the rate based on the specific product or service you’re dealing with.

- Choose Add or Subtract VAT:

- Add VAT: This option adds the VAT to the net price to show the total amount, including tax.

- Subtract VAT: This option subtracts the VAT from the gross price to show the net price before tax.

Detailed Description and How the Tool Works

Think of this calculator as your VAT-savvy friend who’s really good at math. Here’s what it does:

- Add VAT: Let’s say you’re selling something for AED 100 – the calculator will figure out that sweet 5% (AED 5) and tell you the final price is AED 105. Easy peasy!

- Subtract VAT: Got a price tag of AED 105 and wondering what the original price was? The calculator will strip away that 5% VAT and show you it was originally AED 100.

It’s perfect for small business owners, freelancers, or anyone who’s ever stared at a receipt wondering “what’s the price without VAT?”

Example Calculation for Adding VAT:

- Net Price: AED 100

- VAT Rate: 5%

- VAT Amount: AED 5

- Total Price: AED 105

Example Calculation for Subtracting VAT:

- Gross Price: AED 105

- VAT Rate: 5%

- VAT Amount: AED 5

- Net Price: AED 100

Purpose of the Tool and Relevant Information

This little tool is like your personal VAT assistant – it helps you stay on the right side of UAE tax laws without breaking a sweat. And here’s a fun fact: not everything in the UAE gets hit with that 5% VAT. You’ve got:

- Zero-rated goods (such as certain educational materials or healthcare services) are taxed at 0% VAT.

- Exempt items (such as residential properties or local passenger transport) are not subject to VAT at all.

By using the VAT calculator, you can ensure you’re applying the correct VAT rate based on the type of product or service you’re working with.

Example of VAT Calculation for Different Scenarios

| Description | Net Price (AED) | VAT Rate (%) | VAT Amount (AED) | Total Price (AED) |

| Standard Item (Add VAT) | 100 | 5% | 5 | 105 |

| VAT-Inclusive Price (Subtract) | 105 | 5% | 5 | 100 |

| Zero-Rated Item | 100 | 0% | 0 | 100 |

FAQ

What is VAT in the UAE?

VAT (Value Added Tax) is a consumption tax that was introduced in the UAE in January 2018. The standard VAT rate is 5%, which applies to most goods and services. However, some items may be zero-rated or exempt from VAT.

How do I use the VAT calculator?

To use the VAT calculator, simply enter the amount (net or gross), select the VAT rate (usually 5%), and choose whether you want to add or subtract VAT. The calculator will show the VAT amount and the total price accordingly.

What is the difference between adding and subtracting VAT?

– Add VAT: This option is used when you have the net price (before VAT), and you want to calculate the total price including VAT.

– Subtract VAT: This option is used when you have the total price (after VAT), and you want to calculate the price before VAT was added.

Do I need to register for VAT in the UAE?

If your business has an annual turnover of more than AED 375,000, you are required to register for VAT. Businesses with a turnover between AED 187,500 and AED 375,000 can opt for VAT registration, while those with turnover below AED 187,500 are not required to register.

What are zero-rated and exempt goods?

Zero-rated goods are items that are taxed at 0% VAT, such as educational materials or international transportation. Exempt goods are items that are not subject to VAT at all, such as residential properties or local passenger transport services.

Look, dealing with VAT doesn’t have to be a headache. This calculator is like having a mini accountant in your pocket – it helps you figure out VAT in seconds, keeps you on track with tax rules, and saves you from those “did I calculate that right?” moments. Whether you’re running a business or just curious about how much VAT you’re paying, this tool’s got your back. No more mental math needed – just quick, accurate VAT calculations at your fingertips!