The AECB credit score controls every financial opportunity you have in the UAE financial environment of today. Your knowledge of your AECB score becomes crucial before applying for house purchase loans or car financing or aiming to enhance your financial situation. The guide presents modern information and useful advice to help you successfully manage your credit in 2025.

What is AECB?

The Al Etihad Credit Bureau (AECB) operates as a Public Joint Stock Company that belongs completely to the UAE Federal Government. AECB obtains credit data through bank, financial institution and utility company reports. AECB transforms obtained data into credit reports alongside scores which lenders use for evaluating credit fitness of individuals and businesses.

Understanding Your AECB Credit Score

Your AECB credit score exists between 300 and 900 points as a prediction of your ability to pay credit obligations on time. Your credit score determines your creditworthiness through its level so lenders assess your credit risk.

AECB Score Range Interpretation in 2025

| Credit Score Range | Stars Allotted | Category | Interpretation |

| 746 to 900 | 5 | Very High | Excellent credit standing; eligible for the best terms and rates |

| 711 to 745 | 4 | High | Strong credit profile; favorable loan terms likely |

| 651 to 710 | 3 | Medium | Moderate credit risk; standard loan terms available |

| 541 to 650 | 2 | Low | Higher credit risk; may face higher interest rates |

| 300 to 540 | 1 | Very Low | Very high credit risk; difficulty securing credit |

How is Your AECB Score Calculated?

The complex AECB algorithms prevent individuals from conducting self-score calculations but payment history represents the most significant scoring element among several other factors:

- Payment History (35%): Your payment history represents the most influential component that determines your credit score because it accounts for 35% of the total score calculation. Your payment history demonstrates if you met due dates for credit cards and loans together with utility bill payments.

- Credit Utilization: Your credit utilization depends on the amount you have borrowed against your total credit limits. A utilization rate under 30% leads to more favorable assessment of creditworthiness.

- Length of Credit History: Your credit score gains strength through extended credit record duration since it creates a broader profile of your credit behavior.

- Types of Credit in Use: A credit score benefits from a combination of different credit types which includes installment loans and revolving credit among others.

- New Credit Applications: Your credit score can suffer when you apply for new credit because too many applications within a brief period will negatively affect your score.

- Debt Burden Ratio: The Debt Burden Ratio indicates the amount of your income spent on debt repayment.

Accessing Your AECB Credit Score in 2025

Official AECB Channels

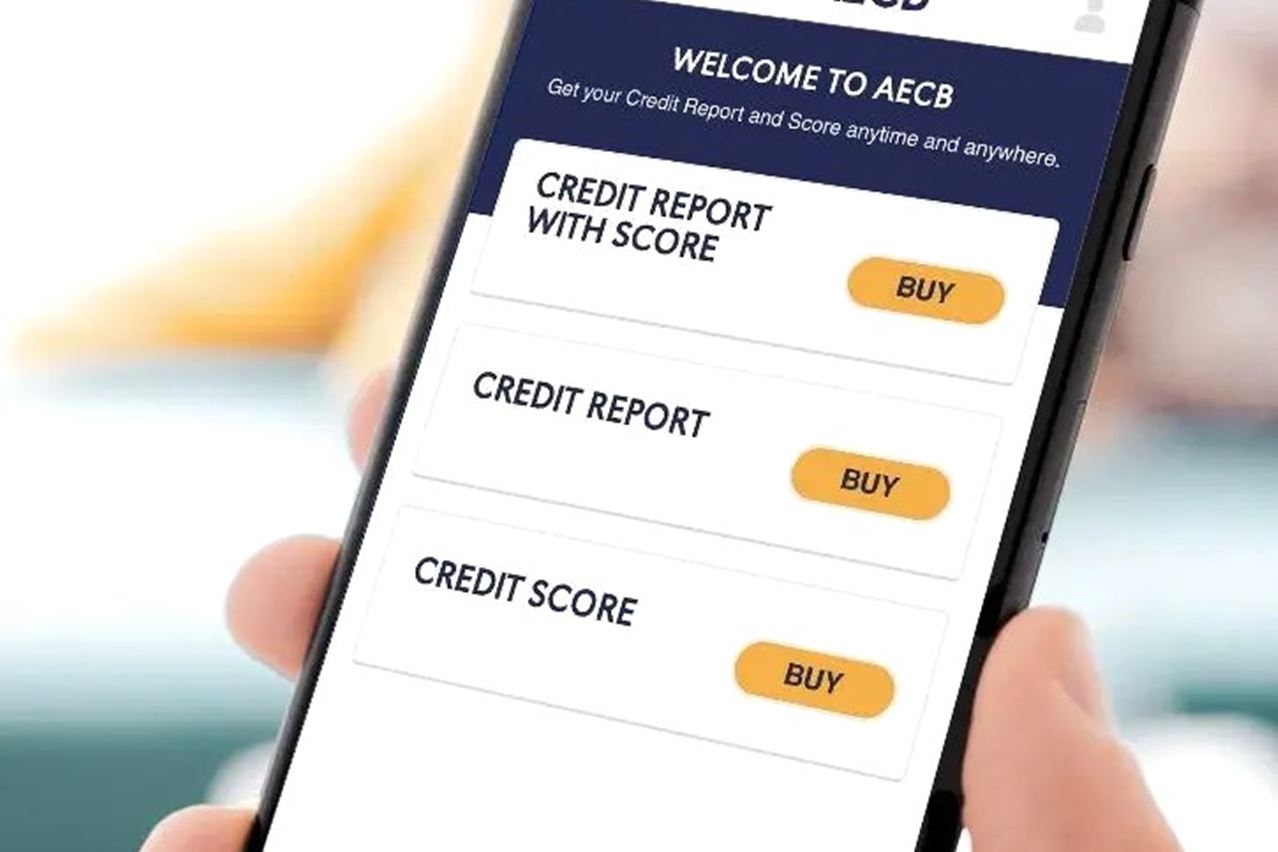

You can retrieve your AECB credit information by using:

- AECB website

- AECB mobile app

- Visiting an AECB branch in person

Cost of AECB Reports in 2025

- Credit Report and Score: AED 100 + VAT

- Credit Report Only: AED 80 + VAT

- Credit Score Only: AED 30 + VAT

Free AECB Score Check

Free credit score verification services are available through financial platforms that work with AECB. Through these services users can check their scores free of charge without incurring the standard fee.

Importance of Your AECB Score in 2025

Different financial aspects in your life depend on the outcome of your AECB score calculation:

- Loan and Credit Card Approvals: Financial institutions base their decision on loan and credit card approval through examining your AECB score when you apply.

- Interest Rates and Terms: Loans with superior interest rates together with better terms are commonly offered to individuals who achieve higher AECB scores.

- Credit Limits: The amount of credit that lenders provide depends on your current credit score.

- Rental Applications: Landlords together with property management companies inspect your credit score for rental application assessment.

- Employment Opportunities: Certain employers use credit scores during background checks to evaluate job candidates who need to demonstrate financial responsibility for employment purposes.

Credit Score Requirements for Financial Products in 2025

- Home Loans: Most home loans in the UAE require applicants to have a minimum credit score of 620 according to lender-specific requirements. Higher credit scores starting from 740 produce the most advantageous home loan rates and conditions.

- Car Loans: A credit score at or above 600 is necessary to obtain car loans and better terms become available when the score reaches above 700.

- Credit Cards: Customers seeking credit cards need scores exceeding 650 but premium cards usually need scores above 700.

Strategies to Improve Your AECB Credit Score in 2025

- Make Timely Payments: Timely payments include regular payments of bills alongside loan payments and credit card statements. You should establish automatic payment systems with scheduled reminders to prevent tardy payments.

- Manage Credit Utilization: You should control your credit utilization to maintain a ratio under 30%. You should request higher credit limits for better ratio improvement without decreasing your current spending.

- Diversify Your Credit Portfolio: The optimal credit profile contains a combination of credit accounts which includes credit cards personal loans and mortgages.

- Limit New Credit Applications: Apply for new credit lines only after a considerable time has passed because numerous hard inquiries during this period will damage your credit score.

- Regularly Check Your Credit Report: You need to review your credit report frequently to identify any incorrect information which you should handle without delay.

- Maintain Long-Standing Credit Accounts: You should keep older credit accounts active even if you do not use them frequently because credit history duration affects your credit score.

- Pay Down Existing Debt: The first step toward debt reduction should focus on paying down your existing debt by starting with the high-interest accounts.

Recent Developments in AECB Scoring for 2025

The AECB expanded its scoring capability by adding further data sources into its credit scoring system from:

- Cheque clearance history

- Monthly payslips

- Utility bill payments

- Court-imposed financial obligations

The expanded view of financial behavior helps individuals with minimal traditional bank transactions better show their financial patterns.

Foreign newcomers in the UAE now gain access to financial services thanks to the partnership between AECB and Nova Credit which allows them to use their previous credit history from their home country.

Challenging Discrepancies in Your Credit Report

The AECB report contains multiple ways to dispute incorrect information:

- Use the data correction tool on AECB’s website

- Email AECB at [email protected] with supporting documents

- Call AECB’s Contact Center at 800 287 328

- Visit an AECB customer experience center in Dubai or Abu Dhabi

The data providers responsible for disputes must follow UAE Central Bank guidelines to respond within 10 working days yet the resolution timeframe depends on specific circumstances and can extend to 20 working days.

Building Credit When You Don’t Have a Score

You should use the following methods if you do not have a credit score:

- Get a Secured Credit Card: The requirement to deposit cash into secured credit cards makes them work as credit limits.

- Take a Small Personal Loan: A personal loan from an AECB reporting bank offers an excellent opportunity to build credit through timely payments of small loan amounts.

- Put Utility Bills in Your Name: Your utility service registration should include your name together with regular payments to maintain your service.

- Become an Authorized User: You can improve your credit by becoming an authorized user through a family member who has excellent credit standing on their credit card account.

- Obtain Retail or Store Cards: Store-specific cards usually accept borrowers who cannot meet the requirements of regular credit cards.

Monitoring Your Credit in 2025

Regular examination of your credit score provides you with the following advantages:

- Detect and address errors promptly

- Identify potential fraud or identity theft

- Track improvements in your credit profile

- Make informed financial decisions

Checking your AECB score through annual monitoring serves as an important activity for financial health assessment.

Governance and Legal Framework

The AECB functions under a defined set of regulations which establish:

- Federal Law No. 6 of 2010 on Credit Information

- Implementing Regulation (Cabinet Decision No. 115/2021)

- Central Bank Decision No. 67/5/2015 on the Work Regulations of Al Etihad Credit Bureau

The regulations impose strict requirements on AECB regarding clear information sharing as well as the protection of data confidentiality and consumer agreement in credit information management.

Frequently Asked Questions (FAQ)

What is my AECB credit score?

Your AECB credit score is a 3-digit number between 300 and 900 that indicates your creditworthiness. The higher your score, the better your credit history and the more favorable terms you can receive from lenders.

How long does it take to improve my AECB credit score?

Improving your credit score is a gradual process that depends on your financial situation and the specific actions you take. With consistent effort such as making timely payments and reducing debt levels, noticeable improvements can generally be observed within a few months, but significant changes might take longer.

Where can I get my AECB credit score in the UAE?

You can check your AECB credit score through the official AECB website, mobile app, or by visiting an AECB branch. Some financial platforms also offer free credit score checks through partnerships with AECB.

Do telecom companies use credit scores to assess applications for services?

Yes, telecommunication companies may check your credit score to understand your creditworthiness, especially when you apply for postpaid services.

How is the AECB credit score calculated?

AECB considers several factors to compute your credit score, including your payment history, debt-burden ratio, bill payment, the number of credit applications you make, credit utilization, length of credit history, and types of credit used.

How can I get inaccurate information corrected in my credit report?

If you find errors in your credit report, you can dispute them by using the data correction tool on AECB’s website, emailing AECB with supporting documents, calling their contact center, or visiting an AECB customer experience center.

What practices can lower my AECB credit score?

Practices that can lower your score include regularly missing or delaying payments, bouncing cheques, holding multiple loans and credit cards, frequently reaching your credit card limit, having accounts sent to collections, and applying for multiple credit lines in a short period.

What does a credit score report include?

Your credit report contains details such as your past and present loans, payment history for up to 5 years, late payments, defaults, bounced cheques, credit inquiries, and public records related to your finances.

How does the credit report help banks and other financial institutions?

The credit report shows your financial obligations to banks, civil bodies, and other creditors, helping financial institutions determine your creditworthiness before approving your credit card or loan applications.

What’s the difference between a credit score, credit rating, and credit report?

A credit score is a numerical value (300-900) that summarizes your creditworthiness. A credit rating is an assessment typically expressed alphabetically (AA, BB, etc.) and is mainly used for businesses and governments. A credit report is a detailed document of your credit history that includes your score and other comprehensive financial information.

Can I improve my AECB credit score within a month?

No, improving your AECB score typically takes more than a month. It’s a gradual process that requires consistent responsible financial behavior over time.

What should I do if I notice a sudden change in my credit score?

If you notice an unexpected change in your credit score, review your credit report for potential errors, check for signs of identity theft, and consider recent actions that might have affected your score, such as closing a credit card or applying for new credit.

Are AECB credit scores used outside of the UAE?

No, AECB credit scores are specific to the UAE financial system and are not typically used by lenders in other countries, who rely on their own national credit reporting systems.

Financial health in the UAE requires a strong AECB credit score to succeed. To maximize your financial potential and reach your financial goals after 2025 you need to learn about your AECB credit score and properly monitor it while creating methods to boost or preserve it.

The journey to build and sustain a solid credit score demands patience because it requires the same duration as marathon racing. The establishment of reliable responsible behavior practices throughout time develops an excellent credit profile.